Is Your Lyft, Sidecar or Uber Insurance Coverage Good Enough?

Is Your Lyft, Sidecar or Uber Insurance Coverage Good Enough?

Since Uber and Lyft became popular a few years ago, the insurance industry has been scrambling to figure out how the liability of accidents will work. Will the company be responsible? Or will it be the driver’s own auto insurance that will cover them? Complications arose in this topic because:

- Vehicles do not belong to the ride-share company, they are owned by the individual drivers

- These drivers are not considered employees of the Ride-sharing companies

- The cars are used for both business (ridesharing) and personal use

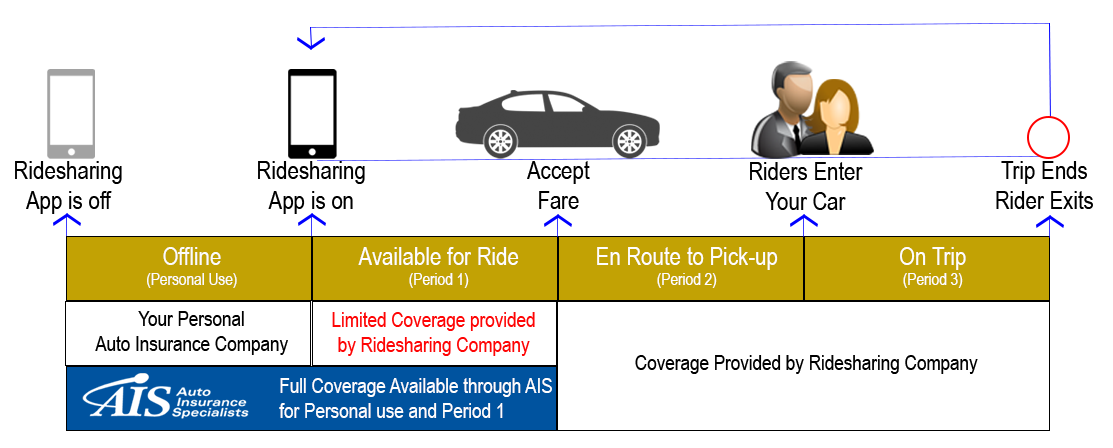

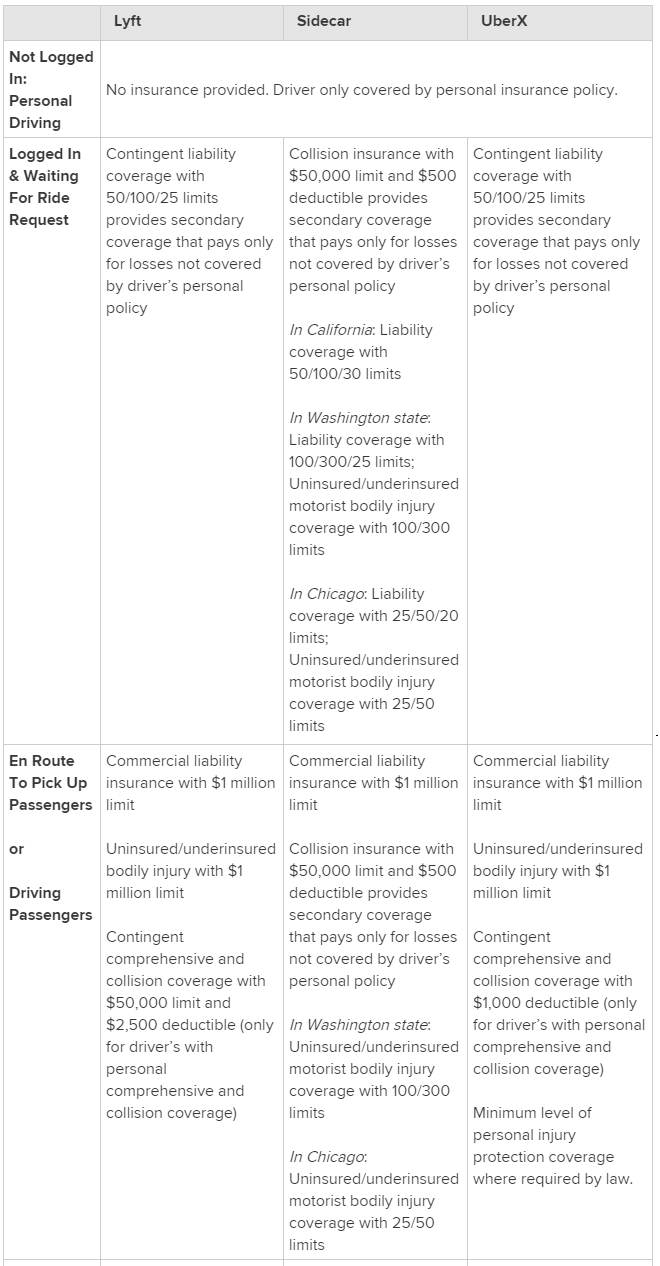

Currently, how the liability coverage for Ride-sharing drivers, for companies like Uber, Lyft and Sidecar, works is seen in this table below:

Source: Table created by Wallethub.com, with information from Lyft, Sidecar and Uber websites as of June 2015

Source: Table created by Wallethub.com, with information from Lyft, Sidecar and Uber websites as of June 2015

What Insurance Do You need to Buy?

Personal car insurance WILL NOT be sufficient if you are a ride-share driver, especially because you risk getting your policy canceled if your auto insurance carrier finds out that you are using your car for business purposes. Commercial car insurance is typically TOO expensive for a ride-share driver, costing about $5,000 to $7,000 per year. You would also be required to get a commercial driver’s license.

So, what is the right coverage to get? Uber Insurance, Rideshare Insurance, or Lyft Insurance. Whichever company you’re looking to get covered for, Ridesharing Insurance (aka Transportation Network Coverage) is what you’re looking for. Mercury Insurance now offers Ridesharing insurance for Private Passenger Auto Policyholders. For the gaps in Sidecar, Lyft or Uber Insurance provided, Ridesharing Insurance will give you the coverage you need. You would be covered during the time that the application/platform is turned on, but have not accepted a call for a ride. Additional premiums will apply to the added coverage, of course. It is important to note that this Transportation Network Coverage will kick in, only during the time that the driver has not connected with a passenger; the time before the driver accepts a dispatch.

This new endorsement offered by Mercury will help over 100,000 California drivers that are contracted with the ridesharing companies. Ensure that you’re covered while you’re out driving. Sidecar, Lyft, and Uber Insurance should be a top priority when you’re out driving. It may be a flexible and enjoyable job, but it can get very complicated if you don’t understand your financial protection if an accident were to occur while you are on-call for these ridesharing apps.

Get more information about Ridesharing Insurance

Call AIS to learn more about how you can add this Ridesharing Insurance to your Auto Insurance policy if you are a driver for any of these Ridesharing companies. Protect yourself with the right insurance coverage when the companies won’t protect you.

The information in this article was obtained from various sources. This content is offered for educational purposes only and does not represent contractual agreements, nor is it intended to replace manuals or instructions provided by the manufacturer or the advice of a qualified professional. The definitions, terms and coverage in a given policy may be different than those suggested here and such policy will be governed by the language contained therein. No warranty or appropriateness for a specific purpose is expressed or implied.