Becoming an Uber, Lyft or other type of rideshare driver has become increasingly popular within the last few years. Many people choose to be a rideshare driver to bring in some extra cash on the side, or even as their full-time job. Are you a rideshare driver? If so, it’s important to know that you need special Rideshare Insurance. Your regular Auto Insurance does not cover you in all situations.

Read on to learn more about rideshare drivers and the insurance they need for the best protection.

A Growing Industry

As of 2017, about 53% of people in the U.S. use ridesharing apps according to Statista. This was an increase from 38% in 2016. The two largest companies in the U.S. ridesharing market are Uber and Lyft, but more companies enter the market every year. So, it’s no surprise that so many people are choosing to make money in this market as a rideshare driver.

As of 2017, about 53% of people in the U.S. use ridesharing apps according to Statista. This was an increase from 38% in 2016. The two largest companies in the U.S. ridesharing market are Uber and Lyft, but more companies enter the market every year. So, it’s no surprise that so many people are choosing to make money in this market as a rideshare driver.

In fact, The Rideshare Guy conducted a 2018 poll revealing that nearly 8 in 10 rideshare drivers are signed up with two or more services. These rideshare services included Uber and Lyft, among others. The poll also explained that the majority of drivers chose the rideshare industry because of its pay and flexibility. However, much to our dismay, it further revealed that almost 50% of rideshare drivers do not have Rideshare Insurance.

Did You Know There’s A Gap In Your Coverage?

It’s promising to know that there has been an increase in drivers obtaining Rideshare Insurance. In 2017, only 33.3% of rideshare drivers said they purchased Rideshare Insurance. In 2018, that number increased to 46.5%. This increase could be due to the fact that more drivers are becoming aware of a gap in their coverage while on the job. Yes, you read that correctly. Your personal Car Insurance and the insurance provided by your rideshare company leave a gap in coverage during every ride.

Personal Auto Insurance v. Rideshare Company’s Insurance

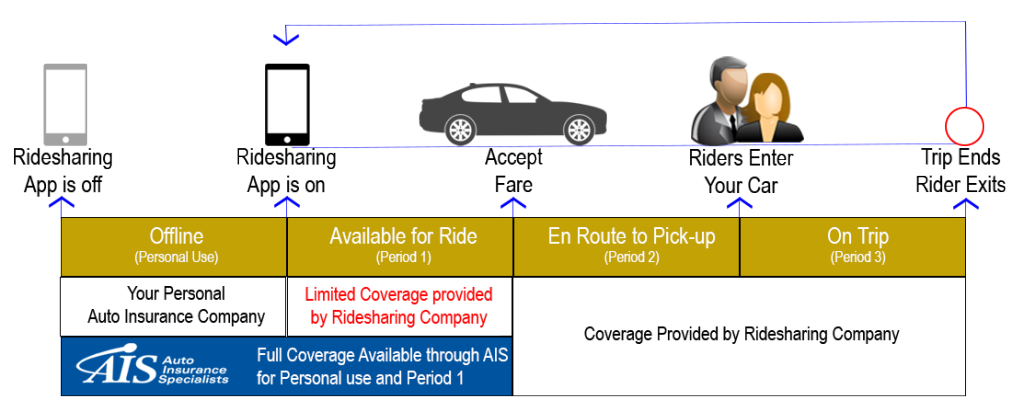

During every ride as a rideshare driver, there is a moment when you’re in what is essentially “insurance limbo”. This limbo occurs when you’re in between the coverage provided by your personal insurance and your company’s insurance. To better understand this, let’s break up one ride into four periods:

Period 0. This is before you turn your rideshare app on and start your shift. Basically, you’re offline or, in other words, off the clock. During this time, your personal Auto Insurance covers you if you get into an accident, based on the coverage you have.

Period 0. This is before you turn your rideshare app on and start your shift. Basically, you’re offline or, in other words, off the clock. During this time, your personal Auto Insurance covers you if you get into an accident, based on the coverage you have.- Period 1. The second period is when you turn your rideshare app on to let customers know you’re available for a ride. You’re now on the clock, but there’s no request for a ride yet. This is where coverage gets hairy. During this time, your personal Auto Insurance will not cover you. Your rideshare company may provide some limited coverage, but it varies per company. To clarify, this is during the time that you may be driving with your app on and are still waiting to accept a fare.

- Period 2. This period occurs when a customer has requested a ride and you’re en route to pick them up. Now, your rideshare company’s insurance kicks in. If you get into an accident while you’re already on your way to pick up a passenger, it’s your company’s insurance that covers you.

- Period 3. This is when you’re transporting your passenger to their destination. Your rideshare company’s insurance also covers you during this time. The coverage will apply until the trip ends. If you make yourself available for a ride again after your trip ends, you re-enter Period 1. Once again, you’ll be in limbo between your personal Auto coverage and your company’s coverage.

Avoid Insurance Limbo

To summarize, your rideshare company only covers you during two of the four periods. These include when a fare has been accepted and when a customer is being transported. Also, your personal Auto Insurance only covers you when your rideshare app is turned off. In between these two instances, while you’re waiting to accept a fare, you are not covered. Therefore, if you get into an accident, you’ll have to pay out of your own pocket. We’re pretty sure you want to avoid that. That makes Rideshare Insurance your best bet.

So, When Do I Need Rideshare Insurance?

It’s true that Rideshare Insurance is a new type of coverage that not all carriers offer. However, there are now at least one or two Auto Insurance companies in every state that offer Rideshare Insurance. It’s a good thing, too, because it’s important to have coverage during the limbo period mentioned above. With a specific Rideshare Insurance policy, you’re covered when your app is turned off, as well as when you’re waiting to accept a fare from a customer.

Consider This Scenario

You just turned your Uber app on and plan to accept fares for the next few hours. It’s around 2 P.M. on a Wednesday, so there aren’t a lot of people looking for rides. In fact, it’s already been 10 minutes, and no one has requested a ride. As you wait, you decide to stop at a nearby Starbucks. You scroll through your Starbucks app while driving to pre-order your iced coffee. As you come to a red light, you rear-end the driver in front of you because you weren’t paying attention. No one is injured, but there’s a serious dent in the back of the other driver’s car. Your Uber app is still on, but you weren’t on your way to pick up a passenger. Now what?

You just turned your Uber app on and plan to accept fares for the next few hours. It’s around 2 P.M. on a Wednesday, so there aren’t a lot of people looking for rides. In fact, it’s already been 10 minutes, and no one has requested a ride. As you wait, you decide to stop at a nearby Starbucks. You scroll through your Starbucks app while driving to pre-order your iced coffee. As you come to a red light, you rear-end the driver in front of you because you weren’t paying attention. No one is injured, but there’s a serious dent in the back of the other driver’s car. Your Uber app is still on, but you weren’t on your way to pick up a passenger. Now what?

If you don’t have Rideshare Insurance and something happens to you like the scenario above, you most likely will not be covered for any damages. You will be left to pay for any car repairs yourself. And if someone is hurt in the accident, you will also have to pay for those costs yourself. That’s why it’s so important to have Rideshare Insurance.

How Much Does Rideshare Insurance Cost?

Rideshare Insurance is just as important for part-time rideshare drivers as it is for full-time ones. However, the cost will be the same regardless of how often you drive. Typically, an Auto Insurance policy with Rideshare Insurance costs around $15 more per month. However, some carriers may increase your policy up to 15-20% more. Also, note that Rideshare Insurance is a type of add-on coverage or hybrid policy. Therefore, you cannot have one carrier for your personal Auto Insurance policy and another carrier for your Rideshare Insurance policy. If you need help finding coverage in your state, call an Insurance Specialist at (855) 919-4247.

According to NerdWallet, here are some average rates for add-on Rideshare Insurance:

| Insurance Company | Average Cost of Add-On Rideshare Insurance |

| Allstate | $15-20 per year |

| Mercury Insurance | $6 or more per month |

| Safeco | $10 or less per month |

| State Farm | 15-20% of the premium |

Get A Free Rideshare Insurance Quote

Weekend nights and commuting hours can make being a rideshare driver a dangerous job. We strongly recommend considering adding Rideshare Insurance to your policy. Then, you’ll be covered whether you’re driving on or off the clock. It’s the only way to avoid paying unexpected out of pocket expenses. Are you still confused about your coverage? We’re here to help. Speak with an Insurance Specialist at (855) 919-4247. They can walk you through when you need Rideshare Insurance. They’ll also provide you with a free quote. Rideshare Insurance might even be more affordable than you think.

Weekend nights and commuting hours can make being a rideshare driver a dangerous job. We strongly recommend considering adding Rideshare Insurance to your policy. Then, you’ll be covered whether you’re driving on or off the clock. It’s the only way to avoid paying unexpected out of pocket expenses. Are you still confused about your coverage? We’re here to help. Speak with an Insurance Specialist at (855) 919-4247. They can walk you through when you need Rideshare Insurance. They’ll also provide you with a free quote. Rideshare Insurance might even be more affordable than you think.

The information in this article is obtained from various sources. This content is offered for educational purposes only and does not represent contractual agreements. The definitions, terms and coverages in a given policy may be different than those suggested here. Such policy will be governed by the language contained therein, and no warranty or appropriateness for a specific purpose is expressed or implied.